Report Materials

Why OIG Did This Audit

Generally, for a covered outpatient drug to be eligible for Federal reimbursement under the Medicaid program, manufacturers must pay rebates to the States for drugs under the Medicaid drug rebate program. OIG has conducted a series of audits to examine whether Medicaid State agencies (State agencies) properly invoiced for, and collected, rebates for physician-administered drugs. This report provides the Centers for Medicare & Medicaid Services (CMS) with a summary of the results of our previous OIG reports and identifies potential issues that, if addressed, could bring about significant reductions in costs to the Medicaid program as a result of renewed efforts to collect rebates for physician-administered drugs.

Our objective was to summarize the results from our previous audits of individual State agencies that determined whether the State agencies complied with Federal Medicaid requirements for invoicing manufacturers for rebates for physician-administered drugs.

How OIG Did This Audit

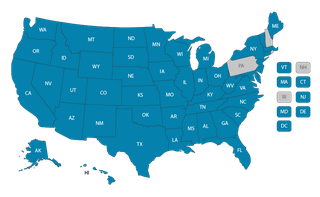

We reviewed each of our 57 previous OIG audits of the Medicaid drug rebate program and summarized the results of those audits for this report. Our 57 previous audits covered physician-administered drug costs that the State agencies claimed for Federal reimbursement. Those audits covered audit periods that ranged from 3 months to 5 years in length, with the earliest audit period beginning on April 1, 2008, and the most recent audit period ending on December 31, 2020.

What OIG Found

Our 57 previous audits of individual State agencies, which we summarize for this report, determined that the State agencies generally did not comply with Federal Medicaid requirements for invoicing manufacturers for rebates for physician-administered drugs and that, in the aggregate, the State agencies could have invoiced for hundreds of millions of dollars in additional rebates. State agencies could have invoiced and obtained rebates from the manufacturers for $225.7 million (Federal share) for physician-administered drugs reimbursed on a fee-for-service basis, and should have collected additional rebates associated with $236.2 million (Federal share) for physician-administered drugs administered to Medicaid managed-care organization enrollees. Furthermore, some State agencies had opportunities to obtain additional rebates for physician-administered drugs beyond those that are required by Federal law. The State agencies generally lacked internal controls, to include policies and procedures, to provide for the collection of adequate and sufficient data to enable the State agencies to collect all rebates for eligible physician-administered drugs.

What OIG Recommends and CMS Comments

We recommend that CMS work with the State agencies to implement internal controls, including policies and procedures, to collect information to facilitate the collection of all rebates for eligible physician-administered drugs; issue finalized guidance to clarify and reinforce the requirement that rebates should be collected for all required physician-administered drugs; and work with and encourage the State agencies to maximize the amount of rebates that can be obtained when feasible, including invoicing for and obtaining rebates in cases when the rebates may not be required.

CMS concurred with our first and third recommendations and described corrective actions. CMS said that States had implemented about 70 percent of the recommendations we made to them in our previous audits, and added that it would continue to provide guidance and technical assistance to the States, to include working with the States on their implementation of internal controls. For our second recommendation, CMS referred to the issuance in May 2023 of a proposed rule that, if finalized, would allow States to invoice for and obtain rebates for all multiple-source physician-administered drugs that are covered outpatient drugs. We believe that the actions that CMS described, when fully executed, should resolve our second recommendation.

View in Recommendation Tracker

Notice

This report may be subject to section 5274 of the National Defense Authorization Act Fiscal Year 2023, 117 Pub. L. 263.