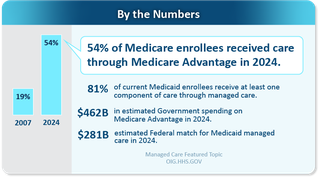

Managed Care

The growth of managed care over the last several years has changed fundamental aspects of the Medicare and Medicaid programs. This significant shift transformed how the government pays for and covers health care for approximately 100 million enrollees.

Strategic Plan

Download the Managed Care Strategic Plan

The OIG has designated oversight of managed care as a priority area. OIG has developed a strategy to align its audits, evaluations, investigations, and enforcement of managed care. The HHS-OIG Strategic Plan for Oversight of Managed Care for Medicare and Medicaid has three goals:

- Promote access to care for people enrolled in managed care

- Provide comprehensive financial oversight

- Promote data accuracy and encourage data-driven decisions

OIG developed the managed care life cycle to guide oversight and enforcement work. The life cycle of managed care is fourfold: plan establishment and contracting, enrollment, payment, and the provision of services. Each stage of this life cycle raises different risks and vulnerabilities.

Resources

Audits

The Office of Audit Services conducts independent audits of HHS programs and/or HHS grantees and contractors. These audits examine the performance of HHS programs and/or grantees in carrying out their responsibilities and provide independent assessments of HHS programs and operations. These audits help reduce waste, abuse, and mismanagement and promote economy and efficiency throughout HHS. The most recent managed care related audits are listed below.

Evaluations and Inspections

The Office of Evaluation and Inspections conducts national evaluations of HHS programs from a broad, issue-based perspective. The evaluations incorporate practical recommendations and focus on preventing fraud, waste or abuse and encourage efficiency and effectiveness in HHS programs. The most recent managed care related evaluations are listed below.

Criminal and Civil

OIG often works with government partners to investigate allegations of fraud in managed care. Some examples of case resolutions involving Medicare and/or Medicaid managed care fraud allegations:

- Troy Health, Inc. Enters Non-Prosecution Agreement and Admits to Fraudulently Enrolling Medicare Beneficiaries and Identity Theft

- Medicare Advantage Provider Seoul Medical Group and Related Parties to Pay Over $62M to Settle False Claims Act Suit

- Health Care Plan Agrees to Pay Over $500,000 As Part of Self-Disclosure of Potential False Claims Act Violations

- MMM Holdings, LLC Agrees to Pay 15.2 Million Dollars to Resolve Allegations that it Violated the False Claims Act and Anti-Kickback Statute

- Medicare Advantage Provider Independent Health to Pay Up To $98M to Settle False Claims Act Suit

- Oak Street Health Agrees to Pay $60M to Resolve Alleged False Claims Act Liability for Paying Kickbacks to Insurance Agents in Medicare Advantage Patient Recruitment Scheme

- Former Executive at Medicare Advantage Organization Charged for Multimillion-Dollar Medicare Fraud Scheme

- Cigna Group to Pay $172 Million to Resolve False Claims Act Allegations

- Martin’s Point Health Care Inc. to Pay $22,485,000 to Resolve False Claims Act Allegations

- California County Organized Health System and Three Health Care Providers Agree to Pay $70.7 Million for Alleged False Claims to California’s Medicaid Program

- California County Organized Health System and Three Health Care Providers Agree to Pay $68 Million for Alleged False Claims to California’s Medicaid Program

- U.S. Attorney Announces $7.85 Million Settlement With Citadel Skilled Nursing Facility In Bronx For Fraudulently Switching Residents' Healthcare Coverage To Boost Medicare Payments

- MCS Advantage Agrees to Pay 4.2 Million Dollars to Resolve Allegations that it Violated the False Claims Act and Anti-Kickback Statute

- Sutter Health and Affiliates to Pay $90 Million to Settle False Claims Act Allegations of Mischarging the Medicare Advantage Program

- Medicare Advantage Provider and Physician to Pay $5 Million to Settle False Claims Act Allegations

- Medicare Advantage Provider to Pay $6.3 Million to Settle False Claims Act Allegations

- Medicare Advantage Provider to Pay $270 Million to Settle False Claims Act Liabilities

OIG annually publishes the top unimplemented recommendations that, in our agency's view, would most positively affect HHS programs in terms of cost savings, program effectiveness and efficiency, and public health and safety if implemented. Recommendations regarding managed care that were unimplemented as of December 2023 appear below.

OIG annually identifies top management and performance challenges HHS faces as it strives to fulfill its mission. View challenges regarding managed care below.

- Ensuring the Financial Integrity of HHS Programs (see page 5)

- Improving Outcomes in Medicare and Medicaid (see page 8)

OIG regularly testifies before Congress in oversight hearings. Below are links for hearings related to managed care.

Whether it’s driving innovation, shaping policy discussions, or catalyzing positive change for the American people, these briefs showcase the value of HHS-OIG efforts.

Last updated February 3, 2026