Drug Spending

Updated: 12-16-2024

For over 25 years, the HHS Office of Inspector General has conducted work to assess drug spending in HHS programs. This work covers three domains: reimbursement, program compliance, and incentive alignment. This page is a compilation of completed reports, unimplemented recommendations, enforcement actions, and industry guidance.

According to data from the Centers for Medicare & Medicaid Services (CMS), U.S. prescription drug expenditures totaled $370 billion in 2019. Spending through Department of Health and Human Services (HHS) programs accounted for 41 percent ($151 billion) of this total. These HHS programs include Medicaid, Medicare Part B (largely for physician-administered drugs), and Medicare Part D (for most outpatient drugs). HHS also administers the 340B Drug Pricing Program (340B program), which enables safety net health care providers to purchase outpatient drugs at discounted prices.

OIG has a long history of successes in improving payment policy for prescription drugs, including a prominent role in highlighting vulnerabilities in the prior reimbursement methodologies in Medicare Part B and Medicaid. OIG's reports and enforcement work helped pave the way for legislative and programmatic changes that better aligned reimbursement amounts with provider acquisition costs, thereby saving the programs and their beneficiaries billions of dollars.

Today, OIG continues its commitment to promoting efficiency in HHS drug programs. OIG's portfolio on drug spending focuses on the following areas: reimbursement, program compliance, and incentive alignment.

Reimbursement

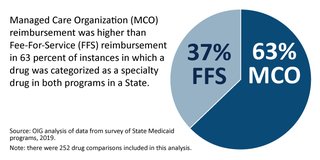

Evolving drug reimbursement and rebate policies have a tremendous financial impact on Federal drug spending. OIG identifies circumstances where Medicare and Medicaid reimbursement rates for prescription drugs do not appropriately reflect provider acquisition costs, resulting in programs and beneficiaries paying too much. OIG work includes reviews of potential savings from various pricing and rebates methodologies and prescribing schemes in HHS programs; examining the effect of "bundling" payments on costs for drugs to treat end-stage renal disease (ESRD); and comparing the impact of different payment methodologies across the Medicare, Medicaid, and 340B programs. OIG plays a role in examining reimbursement rates for Part B drugs by reporting quarterly on Average Sale Prices (ASPs) and Average Manufacturer Prices (AMPs), at the request of Congress.

Program Compliance

Drug manufacturers, State Medicaid agencies, and other entities must comply with statutory and program requirements. OIG has a body of work on program compliance, which include reviews of the effectiveness of Medicaid's rebate-collection efforts and whether all parties are adhering to 340B program requirements.

Incentive Alignment

In certain situations, entities involved with HHS programs may have incentives not aligned with HHS program goals that adversely affect those programs and their beneficiaries out of pocket drug spending. OIG work includes examinations of Medicare Part D plan sponsors' insights into the services and information provided by pharmacy benefit managers (PBMs) and of conflicts of interest on pharmacy and therapeutics (P&T) committees.

Reports and Recommendations

OIG makes recommendations to HHS that promote efficiency and effectiveness in the administration of HHS programs and operations. These recommendations generally stem from OIG's audits and evaluations. For a list of unimplemented recommendations across HHS programs, see the Top Unimplemented Recommendations.

Below is a list of the unimplemented recommendations in the drug spending area that would most positively affect HHS programs in terms of saving money and/or improving quality and should therefore be prioritized for implementation.

Enforcement

OIG has the authority to seek civil monetary penalties (CMP), assessments, and exclusion against an individual or entity on the basis of a wide variety of prohibited conduct, including that related to the Medicaid Drug Rebate Program. This program requires drug manufacturers to submit pricing information to HHS and to pay a rebate to State Medicaid programs for each unit of the covered drug that State Medicaid programs reimburse. Manufacturers with Medicaid drug rebate agreements are also required to report price information that is used to set average sales price (ASP), the reimbursement metric for most drugs covered by Medicare Part B.

Given the importance of timely and accurate submission of pricing information, OIG may seek a CMP against a drug manufacturer that fails to report in a timely manner the required information or that knowingly submits false information. In September 2010, OIG issued a Special Advisory Bulletin, "Average Manufacturer Price and Average Sales Price Reporting Requirements," that notified drug manufacturers that OIG intended to pursue enforcement actions against manufacturers that failed to submit timely and accurate data necessary for the effective operation of the Medicaid Drug Rebate Program, the 340B program, the Federal Upper Limit Program, and the Medicare Part B outpatient prescription drug benefit. See below for recent cases.

Solco Healthcare Agreed to Pay $200,000 for Allegedly Violating the Civil Monetary Penalties Law by Failing to Submit Timely Pricing Data

On November 29, 2024, Solco Healthcare US, LLC (Solco), Somerset, New Jersey, entered into a $200,000 settlement agreement with OIG. The settlement agreement resolves allegations that Solco failed to submit timely certified monthly and quarterly Average Manufacturer's Price (AMP) data to the Centers for Medicare and Medicaid Services (CMS) for certain months and quarters in 2021, 2022, and 2023. The Medicaid Drug Rebate Program requires manufacturers to enter into and have in effect a national rebate agreement with the Secretary of Health and Human Services in order for Medicaid payments to be available for the manufacturer's covered outpatient drugs. Companies with such rebate agreements are required to submit certain drug pricing information to CMS, including quarterly and monthly AMP data. Senior Counsel Jonathan Culpepper, with the assistance of Program Analyst Mariel Filtz, represented OIG.

H2-Pharma Agreed to Pay $75,000 for Allegedly Violating the Civil Monetary Penalties Law by Failing to Submit Timely Pricing Data

On October 10, 2024, H2-Pharma, LLC (H2-Pharma), Montgomery, Alabama, entered into a $75,000 settlement agreement with OIG. The settlement agreement resolves allegations that H2-Pharma failed to submit timely certified monthly Average Manufacturer's Price (AMP) data to the Centers for Medicare and Medicaid Services (CMS) for certain months and quarters in 2022 and 2023, and also failed to submit timely quarterly Average Sales Price (ASP) data to CMS for certain quarters in 2022 and 2023. The Medicaid Drug Rebate Program requires manufacturers to enter into and have in effect a national rebate agreement with the Secretary of Health and Human Services in order for Medicaid payments to be available for the manufacturer's covered outpatient drugs. Companies with such rebate agreements are required to submit certain drug pricing information to CMS, including monthly AMP data and quarterly ASP data. Senior Counsel Jonathan Culpepper, with the assistance of Program Analyst Mariel Filtz, represented OIG.

Alnylam Pharmaceuticals Agreed to Pay $170,000 for Allegedly Violating the Civil Monetary Penalties Law by Failing to Submit Timely Pricing Data

On May 2, 2024, Alnylam Pharmaceuticals, Inc. (Alnylam), Cambridge, Massachusetts, entered into a $170,000 settlement agreement with OIG. The settlement agreement resolves allegations that Alnylam failed to submit timely certified monthly Average Manufacturer's Price (AMP) data to the Centers for Medicare and Medicaid Services (CMS) for certain months in 2021 and 2023, and also failed to submit timely quarterly Average Sales Price data to CMS for certain quarters in 2020, 2021, and 2023. The Medicaid Drug Rebate Program requires manufacturers to enter into and have in effect a national rebate agreement with the Secretary of Health and Human Services in order for Medicaid payments to be available for the manufacturer's covered outpatient drugs. Companies with such rebate agreements are required to submit certain drug pricing information to CMS, including monthly AMP data and quarterly ASP data. Senior Counsel Gregory Becker, with the assistance of Program Analyst Mariel Filtz, represented OIG.

Precision Dose Agreed to Pay $75,000 for Allegedly Violating the Civil Monetary Penalties Law by Failing to Submit Timely Pricing Data

On April 23, 2024, Precision Dose, Inc. (Precision Dose), South Beloit, Illinois, entered into a $75,000 settlement agreement with OIG. The settlement agreement resolves allegations that Precision failed to submit timely certified monthly and quarterly Average Manufacturer's Price (AMP) data to the Centers for Medicare and Medicaid Services (CMS) for certain months and quarters in 2021, 2022, and 2023. The Medicaid Drug Rebate Program requires manufacturers to enter into and have in effect a national rebate agreement with the Secretary of Health and Human Services in order for Medicaid payments to be available for the manufacturer's covered outpatient drugs. Companies with such rebate agreements are required to submit certain drug pricing information to CMS, including quarterly and monthly AMP data. Senior Counsel Gregory Becker, with the assistance of Program Analyst Mariel Filtz, represented OIG.

Sagent Pharmaceuticals Agreed to Pay $175,000 for Allegedly Violating the Civil Monetary Penalties Law by Failing to Submit Timely Pricing Data

On April 20, 2023, Sagent Pharmaceuticals (Sagent), Schaumburg, Illinois, entered into a $175,000 settlement agreement with OIG. The settlement agreement resolves allegations that Sagent failed to submit timely certified quarterly Average Sales Price (ASP) data to the Centers for Medicare and Medicaid Services (CMS). Specifically, OIG alleged that Sagent failed to submit timely certified ASP data to CMS for all of the calendar quarters from the second quarter of 2020 through the third quarter of 2022. Senior Counsels Gregory Becker and Jonathan Culpepper, with the assistance of Program Analyst Mariel Filtz, represented OIG.

B. Braun Medical Agreed to Pay $200,000 for Allegedly Violating the Civil Monetary Penalties Law by Failing to Submit Timely Pricing Data

On November 10, 2022, B. Braun Medical Inc. (B. Braun), Bethlehem, Pennsylvania, entered into a $200,000 settlement agreement with OIG. The settlement agreement resolves allegations that B. Braun failed to submit timely certified quarterly Average Sales Price (ASP) data to the Centers for Medicare and Medicaid Services (CMS). Specifically, OIG alleged that B. Braun failed to submit timely certified ASP data to CMS for all of the calendar quarters from the fourth quarter of 2019 through the first quarter of 2022. Senior Counsels Gregory Becker and Jonathan Culpepper, with the assistance of Program Analyst Mariel Filtz, represented OIG.

Laurus Labs Agreed to Pay $50,000 for Allegedly Violating the Civil Monetary Penalties Law by Failing to Submit Timely Pricing Data

On July 14, 2022, Laurus Labs Private Limited, (Laurus), Berkely Heights, New Jersey, entered into a $50,000 settlement agreement with OIG. The settlement agreement resolves allegations that Laurus failed to submit timely certified monthly and quarterly Average Manufacturer's Price (AMP) data to the Centers for Medicare and Medicaid Services (CMS) for certain months and quarters in 2021. The Medicaid Drug Rebate Program requires manufacturers to enter into and have in effect a national rebate agreement with the Secretary of Health and Human Services in order for Medicaid payments to be available for the manufacturer's covered outpatient drugs. Companies with such rebate agreements are required to submit certain drug pricing information to CMS, including quarterly and monthly AMP data. Senior Counsels Gregory Becker and Jonathan Culpepper, with the assistance of Program Analyst Mariel Filtz, represented OIG.

Method Pharmaceuticals, LLC Settles Case Involving Drug Price Reporting

On May 21, 2020, Method Pharmaceuticals, LLC (Method), Southlake, TX, entered into a $45,000 settlement agreement with OIG. The settlement agreement resolves allegations that Method failed to submit timely certified monthly and quarterly Average Manufacturer's Price (AMP) data to the Centers for Medicare and Medicaid Services (CMS) for certain months and quarters in 2015, 2016, 2017, and 2018. The Medicaid Drug Rebate Program requires manufacturers to enter into and have in effect a national rebate agreement with the Secretary of Health and Human Services in order for Medicaid payments to be available for the manufacturer's covered outpatient drugs. Companies with such rebate agreements are required to submit certain drug pricing information to CMS, including quarterly and monthly AMP data. Senior Counsel Mary Riordan represented OIG with the assistance of Program Analyst Mariel Filtz.

U.S. Pharmaceutical Corporation Settles Case Involving Drug Price Reporting

On July 19, 2019, U.S. Pharmaceutical Corporation (USPC), Decatur, Georgia, entered into a $380,142.05 settlement agreement with OIG. The settlement agreement resolves allegations that USPC failed to submit timely certified monthly and quarterly Average Manufacturer's Price (AMP) data to the Centers for Medicare and Medicaid Services (CMS) for certain months and quarters in 2012, 2015, 2016, and 2017. The Medicaid Drug Rebate Program requires manufacturers to enter into and have in effect a national rebate agreement with the Secretary of Health and Human Services in order for Medicaid payments to be available for the manufacturer's covered outpatient drugs. Companies with such rebate agreements are required to submit certain drug pricing information to CMS, including quarterly and monthly AMP data. Senior Counsel Mary Riordan represented OIG with the assistance of Program Analyst Mariel Filtz.

Stratus Pharmaceuticals Inc. Settles Case Involving Drug Price Reporting

On August 31, 2017, Stratus Pharmaceuticals Inc. (Stratus), Florida, entered into a $40,000 settlement agreement with OIG. The settlement agreement resolves allegations that Stratus failed to submit certified monthly and quarterly Average Manufacturer's Price (AMP) data to the Centers for Medicare and Medicaid Services (CMS) for certain months and quarters in 2014 and 2015. The Medicaid Drug Rebate Program requires pharmaceutical companies to enter into and have in effect a national rebate agreement with the Secretary of Health and Human Services in order for Medicaid payments to be available for the pharmaceutical company's covered drugs. Companies with such rebate agreements are required to submit certain drug pricing information to CMS, including quarterly and monthly AMP data. Senior Counsel Mary Riordan represented OIG.

Nephron Pharmaceuticals Corporation Settles Case Involving Drug Price Reporting

On July 20, 2016, Nephron Pharmaceuticals Corporation (Nephron), Florida, entered into a $60,000 settlement agreement with OIG. The settlement agreement resolves allegations that Nephron failed to submit certified monthly and quarterly average manufacturer price (AMP) data to the Centers for Medicare & Medicaid Services (CMS) for certain months and quarters in 2013, 2014, and 2015. The Medicaid Drug Rebate Program requires pharmaceutical companies to enter into and have in effect a national rebate agreement with the Secretary of Health and Human Services in order for Medicaid payments to be available for the pharmaceutical company's covered drugs. Companies with such rebate agreements are required to submit certain drug pricing information to CMS, including quarterly and monthly AMP data.

Cipher Pharmaceuticals US LLC Settles Case Involving Drug Price Reporting

On July 20, 2016, Cipher Pharmaceuticals US LLC (Cipher), South Carolina, entered into a $60,000 settlement agreement with OIG. The settlement agreement resolves allegations that Cipher failed to submit certified monthly and quarterly average manufacturer price (AMP) data to the Centers for Medicare & Medicaid Services (CMS) for certain months and quarters in 2014, 2015, and 2016. The Medicaid Drug Rebate Program requires pharmaceutical companies to enter into and have in effect a national rebate agreement with the Secretary of Health and Human Services in order for Medicaid payments to be available for the pharmaceutical company's covered drugs. Companies with such rebate agreements are required to submit certain drug pricing information to CMS, including quarterly and monthly AMP data.

Coloplast Corp. Settles Case Involving Drug Price Reporting

On May 6, 2016, Coloplast Corp. (Coloplast), Minnesota, entered into a $600,000 settlement agreement with OIG. The settlement agreement resolves allegations that Coloplast failed to submit certified monthly and quarterly average manufacturer price (AMP) data to the Centers for Medicare & Medicaid Services (CMS) for certain months and quarters in 2013, 2014, and 2015. The Medicaid Drug Rebate Program requires pharmaceutical companies to enter into and have in effect a national rebate agreement with the Secretary of Health and Human Services in order for Medicaid payments to be available for the pharmaceutical company's covered drugs. Companies with such rebate agreements are required to submit certain drug pricing information to CMS, including quarterly and monthly AMP data.

Ascend Laboratories, LLC Settles Case Involving Drug Price Reporting

On October 7, 2015, Ascend Laboratories, LLC (Ascend), New Jersey, entered into a $1,287,000 settlement agreement with OIG. The settlement agreement resolves allegations that Ascend failed to submit monthly and quarterly average manufacturer price (AMP) data to the Centers for Medicare & Medicaid Services (CMS) for certain months and quarters in 2013 and 2014. The Medicaid Drug Rebate Program requires pharmaceutical companies to enter into and have in effect a national rebate agreement with the Secretary of Health and Human Services in order for Medicaid payments to be available for the pharmaceutical company's covered drugs. Companies with such rebate agreements are required to submit certain drug pricing information to CMS, including quarterly and monthly AMP data.

Glenmark Pharmaceuticals, Inc. USA Settles Case Involving Drug Price Reporting

On August 31, 2015, Glenmark Pharmaceuticals, Inc. USA (Glenmark), New Jersey, entered into a $2,887,300 settlement agreement with OIG. The settlement agreement resolves allegations that Glenmark failed to submit in a timely manner monthly and quarterly average manufacturer price (AMP) data to the Centers for Medicare & Medicaid Services (CMS) for certain months and quarters in 2013 and 2014. The Medicaid Drug Rebate Program requires pharmaceutical companies to enter into and have in effect a national rebate agreement with the Secretary of Health and Human Services in order for Medicaid payments to be available for the pharmaceutical company's covered drugs. Companies with such rebate agreements are required to submit certain drug pricing information to CMS, including quarterly and monthly AMP data.

B.F. Ascher & Company, Inc. Settles Case Involving Drug Price Reporting

On May 8, 2015, B.F. Ascher & Company, Inc. (B.F. Ascher), a Kansas pharmaceutical manufacturer, entered into a $178,000 settlement agreement with OIG. The settlement agreement resolves allegations that B.F. Ascher failed to submit in a timely manner certified monthly and quarterly average manufacturer price (AMP) data to the Centers for Medicare & Medicaid Services (CMS) for certain months and quarters from 2012 to 2014. The Medicaid Drug Rebate Program requires pharmaceutical companies to enter into and have in effect a national rebate agreement with the Secretary of Health and Human Services in order for Medicaid payments to be available for the pharmaceutical company's covered drugs. Companies with such rebate agreements are required to submit certain drug pricing information to CMS, including quarterly and monthly AMP data.

Seton Pharmaceuticals Settles Case Involving Drug Price Reporting

On May 6, 2015, Seton Pharmaceuticals (Seton), a New Jersey specialty generic pharmaceutical company, entered into a $91,800 settlement agreement with OIG. The settlement agreement resolves allegations that Seton failed to submit in a timely manner certified monthly and quarterly average manufacturer price (AMP) data to the Centers for Medicare & Medicaid Services (CMS) for certain months and quarters in 2012 and 2013. The Medicaid Drug Rebate Program requires pharmaceutical companies to enter into and have in effect a national rebate agreement with the Secretary of Health and Human Services in order for Medicaid payments to be available for the pharmaceutical company's covered drugs. Companies with such rebate agreements are required to submit certain drug pricing information to CMS, including quarterly and monthly AMP data.

Sandoz, Inc. Settles Case Involving Misrepresenting Drug Pricing Data to Medicare

On March 11, 2015, Sandoz, Inc. (Sandoz), a New Jersey manufacturer of generic pharmaceuticals, entered into a $12,640,000 settlement agreement with OIG. The settlement agreement resolves allegations that Sandoz misrepresented drug pricing data to Medicare. Federal law requires drug makers to report both accurate and timely ASP data to the Centers for Medicare & Medicaid Services (CMS). CMS uses this information to set payment amounts for most drugs covered under Medicare Part B. Inaccurate pricing information can cause Medicare to overpay for these drugs. News Release

West-Ward Pharmaceuticals Settles Case Involving Drug Price Reporting

On May 10, 2012, West-Ward Pharmaceutical Corp. (West-Ward), a manufacturer of generic pharmaceuticals, entered into a $10,000 settlement agreement with OIG to resolve CMP liability under the Medicaid Drug Rebate Program. This settlement resolved allegations that between January 2004 and December 2010, West-Ward failed to submit in a timely manner its monthly and quarterly average manufacturer price (AMP) and ASP data. The Medicaid Drug Rebate Program requires drug manufacturers to submit pricing information to the Centers for Medicare and Medicaid Services (CMS) and to pay a rebate to the state Medicaid programs for each unit of the covered drug that the state Medicaid programs reimburse. Manufacturers with Medicaid Drug Rebate Program agreements are also required to report price information that is used to set ASP, the reimbursement metric for drugs covered by Medicare Part B.

Sandoz, Inc. Settles Case Involving Drug Price Reporting

On December 12, 2011, Sandoz Inc. (Sandoz), a New Jersey manufacturer of generic pharmaceuticals, entered into a $230,000 settlement agreement with OIG to resolve CMP liability under the Medicaid Drug Rebate Program. This settlement resolves allegations that between October 2009 and March 2011, Sandoz failed to submit in a timely manner monthly and quarterly average manufacturer price (AMP) information and ASP information. The Medicaid Drug Rebate Program requires drug manufacturers to submit pricing information to the Centers for Medicare & Medicaid Services (CMS and to pay a rebate to the State Medicaid programs for each unit of the covered drug that the State Medicaid programs reimburse. Manufacturers with Medicaid Drug Rebate Program agreements are also required to report price information that is used to set ASP, the reimbursement metric for drugs covered by Medicare Part B.

Savient Pharmaceuticals Settles Case Involving Drug Price Reporting

On August 9, 2011, Savient Pharmaceuticals, Inc. (Savient), entered into a $100,000 settlement agreement with OIG to resolve CMP liability under the Medicaid Drug Rebate Program. This settlement resolves allegations that between October 2009 and March 2011, Savient failed to submit in a timely manner monthly and quarterly average manufacturer price (AMP) data. The Medicaid Drug Rebate Program requires drug manufacturers to submit pricing information to the Centers for Medicare & Medicaid Services (CMS) and to pay a rebate to the State Medicaid programs for each unit of the covered drug that the State Medicaid programs reimburse.

Industry Guidance

The Federal anti-kickback statute (1) makes it a criminal offense to knowingly and willfully offer, pay, solicit, or receive any remuneration to induce or reward referrals of items or services reimbursable by a Federal health care program. Where remuneration is paid purposefully to induce or reward referrals of items or services payable by a Federal health care program, the anti-kickback statute is violated. In addition, the civil monetary penalty provision prohibiting inducements to beneficiaries (the CMP) (2) against any person who gives something of value to a beneficiary of Medicare or a State health care program (including Medicaid) that the benefactor knows or should know is likely to influence the beneficiary's selection of a particular provider, practitioner, or supplier of any item or service for which payment may be made, in whole or in part, by Medicare or a State health care program (including Medicaid).

The resources below provide guidance on OIG's interpretation and enforcement of these statutes in the context of drug pricing and reimbursement.

- OIG Policy Statement Regarding Hospitals That Discount or Waive Amounts Owed by Medicare Beneficiaries for Self-Administered Drugs Dispensed in Outpatient Settings (October 29, 2015) This document assures hospitals that they will not be subject to OIG administrative sanctions for discounting or waiving amounts that Medicare beneficiaries may owe for self-administered drugs they receive in outpatient settings when those drugs are not covered by Medicare Part B, subject to certain specified conditions.

- Special Advisory Bulletin: Pharmaceutical Manufacturer Copayment Coupons (September 16, 2014) This special advisory bulletin was issued concurrently with a report that analyzed the measures pharmaceutical manufacturers use to prevent their coupon programs from inducing the purchase of drugs paid for by Medicare Part D.

- Special Advisory Bulletin: Patient Assistance Programs for Medicare Part D Enrollees (November 7, 2005) and Supplemental Special Advisory Bulletin: Independent Charity Patient Assistance Programs (May 21, 2014) These related special advisory bulletins provide guidance regarding patient assistance programs operated by independent charities that provide cost-sharing assistance for prescription drugs. (News Release)

- Compliance Program Guidance for Pharmaceutical Manufacturers (68 Fed. Reg. 23731; May 5, 2003) This guidance sets forth specific elements that pharmaceutical manufacturers should consider when developing and implementing an effective compliance program and includes a discussion of key areas of potential risk under the anti-kickback statute.

Additional Resources

- Series: States' Collection of Medicaid Rebates from Drug Manufacturers

- Federal Payments for Medicare Part D Catastrophic Coverage, 2006-2015

- Report: Average Sales Prices: Manufacturer Reporting and CMS Oversight (OEI-03-08-00480)

- Report: Drug Manufacturers' Noncompliance With Average Manufacturer Price Reporting Requirements (OEI-03-09-00060)

- Special Advisory Bulletin: Average Manufacturer Price and Average Sales Price Reporting Requirements

Related Podcast

- Medicare Part B Overpaid Millions for Selected Outpatient Drugs

- Manufacturer Safeguards May Not Prevent Copayment Coupon Use for Part D Drugs

- Medicare Part B Prescription Drug Dispensing and Supplying Fee Payment Rates

- Contract Pharmacy Arrangements in the 340B Drug Discount Program

- Oversight of Medicare Prescription Drug Decisions

Related Video

- Compliance Program Basics

- Federal Anti-Kickback Statute

- HHS OIG testifies on the 340B Drug Pricing Program

Related Testimony

- Examining Oversight Reports on the 340B Drug Pricing Program

- Pricing of Separately Billable End Stage Renal Disease Drugs

- Medicare Part B Prescription Drug Reimbursements

Footnotes

1 See section 1128B(b) of the Social Security Act.

2 See section 1128A(a)(5) of the Social Security Act.